The video discusses how President Donald Trump has drawn inspiration from President William McKinley regarding tariff policies. McKinley, known as the "tariff king," implemented significant tariff bills during his time, although he eventually shifted his perspective, favoring international trade over protectionism. Trump has followed McKinley's early approach by using tariffs and championing the idea of making America wealthy again through import taxes.

The historical context of tariffs is explored, highlighting McKinley’s use of tariffs initially for revenue, protectionism, and later, reciprocity. Despite their differing political contexts, both presidents used tariffs to address economic issues, such as reducing national debt and modifying trade relations. Surprisingly, McKinley eventually pushed for reduced tariffs to open foreign markets through reciprocity treaties, a shift indicated during his second presidential term.

Please remember to turn on the CC button to view the subtitles.

Key Vocabularies and Common Phrases:

1. protectionism [prəˈtɛkʃəˌnɪzəm] - (n.) - An economic policy of restricting imports from other countries, typically to protect domestic industries. - Synonyms: (trade barriers, import restrictions, economic isolationism)

It really changes his mind in some sense and wants to shift the focus of trade policy away from protectionism and isolationism and allow for more international trade as a way of helping the US economy

2. reciprocity [rɛsɪˈprɒsɪti] - (n.) - The practice of exchanging things with others for mutual benefit, especially trading privileges between countries. - Synonyms: (mutual exchange, trade-off, mutual benefit)

And as president, McKinley began to think about using tariffs for their third reciprocity.

3. revenue [ˈrɛvənjuː] - (n.) - Income generated from normal business operations or government initiatives like taxes. - Synonyms: (income, proceeds, earnings)

The first one, revenue, is the oldest use for tariffs in the U.S.

4. surplus [ˈsɜːpləs] - (n.) - An amount of something left over when requirements have been met; an excess of production or supply. - Synonyms: (excess, remainder, overabundance)

The US had a huge surplus and had basically paid off all the Civil War debt.

5. exclusive [ɪkˈskuːsɪv] - (adj.) - Restricted to the person, group, or area concerned. - Synonyms: (select, limited, restricted)

The former self described tariff man said, the period of exclusiveness is past.

6. isolationism [ˌaɪsəˈleɪʃəˌnɪzəm] - (n.) - A policy of remaining apart from the affairs or interests of other groups, especially the political affairs of other countries. - Synonyms: (non-intervention, detachment, separation)

...wants to shift the focus of trade policy away from protectionism and isolationism ...

7. excise [ˈɛkˌsaɪz] - (n.) - A tax levied on certain goods and commodities produced or sold within a country and on licenses for certain activities. - Synonyms: (tax, duty, levy)

During the Civil War, the government started using excise taxes like we still have today.

8. saturate [ˈsætʃəˌreɪt] - (v.) - To fill something to the point where no more can be absorbed or added. - Synonyms: (soak, fill, drench)

American manufacturers, they're really good. They've sort of saturated the domestic market.

9. annex [ˈænɛks] - (v.) - To append or attach, especially to a larger or more significant entity. - Synonyms: (add, attach, append)

If purchased by chance. Some of our tariffs are no longer needed for revenue or to encourage and protect our industries at home.

10. retaliation [rɪˌtælɪˈeɪʃən] - (n.) - The action of returning a military attack; counterattack. - Synonyms: (revenge, reprisal, vengeance)

McKinley gave a surprising speech to a crowd of tens of thousands. The former self described tariff man said, the period of exclusiveness is past. reciprocity treaties are in harmony with the spirit of the times. Measures of retaliation are not.

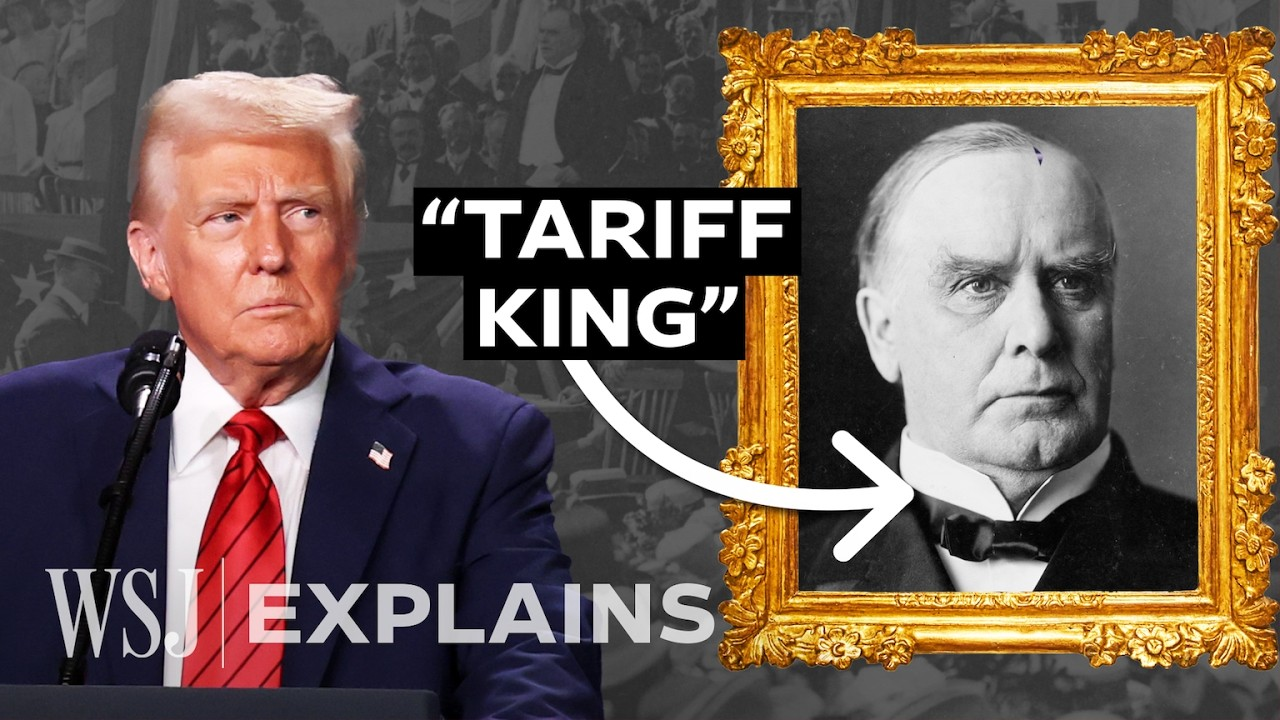

Why Trump’s Tariff Idol, McKinley, Abandoned His Own Tariff Policy - WSJ

When it comes to tariffs, President Donald Trump really looks up to President McKinley, like a lot. William McKinley, William McKinley. William McKinley, highly underrated, has not been properly recognized. William McKinley as an example. He was a big tariff president. He was a strong believer in tariffs. McKinley did oversee one of the biggest tariff bills in U.S. history. He was the tariff king. He called himself a tariff man standing on a tariff platform, but in his second term, he basically abandoned that platform. It really changes his mind in some sense and wants to shift the focus of trade policy away from protectionism and isolationism and allow for more international trade as a way of helping the US economy.

Here's how McKinley used tariffs, how Trump is following a similar playbook, and why McKinley actually came to speak out against them. This is Duggar when he literally wrote the book on the history of tariffs, and he said they can be classified into three main objectives. The three Rs of trade policy are revenue restriction and reciprocity. Throughout McKinley's career, tariffs were used for each of these at one point, and Trump wants to use all three, too.

The first one, revenue, is the oldest use for tariffs in the U.S. trump says this chart shows how tariffs created vast wealth for our country and how tariffs will make America wealthy again. It's the percent of all government revenue that comes from tariffs. For the last 70 years, it's hung around 2%. But 200 years ago, it was nearly 100. We were very much an agrarian society with most people being farmers. And so import tariffs were just sort of an efficient way of raising revenue.

During the Civil War, the government started using excise taxes like we still have today. Taxes on, like, alcohol and gasoline, even those made in the US and McKinley's story really starts around here in the 1880s when the US collected about half its revenue from tariffs. Too much revenue, actually. The US Had a huge surplus and had basically paid off all the Civil War debt.

It was actually a big problem, a problem like I hope to have with this country someday. Our country was so rich, we didn't know what to do with all the money we had. No, really, it was like a problem. If you've paid off all the debt, there's no reason to run a fiscal surplus because then the government's just accumulating money, the people's money, and not spending. It's just sitting in government coffers and in government safes. So what's the point of that?

So the tariff question was the alligator monster, monster sized problem for Congress at the time. What rate should tariffs be in order to bring in less money and reduce this surplus. Congress ultimately decided that they should be higher. The debate was on this, what we now call the Laffer curve. It shows the relationship between how high the tax rate is and how much revenue it brings in it, in this case from imports.

They both wanted to get the revenue down to this range. Democrats wanted to lower the tariff rate so that they'd bring in less revenue on imported goods. The Republicans said, that's insanity. If you cut the tariff rates, you're going to encourage more imports. That's going to generate more revenue, and it'll exacerbate the problem. So what you have to do is raise tariff rates to squeeze out imports, and then the revenue will go away.

Or as McKinley put it, if you increase them enough, you diminish importations and to that extent, diminish the revenue. He, by the way, wasn't president. All tax legislation has to start in the House Ways and Means Committee. Who's chair of the House Ways and means Committee? William McKinley, a representative from the state of Ohio, which is why these tariff increases became known as the McKinley tariffs.

And they had one other restriction, or as it was called back then, protectionism. In the words of President McKinley, who is the tariff king, the protective system invokes the highest law of nature, self preservation. Sometimes you don't want the revenue. You want to restrict imports from coming in, from hurting domestic industries, and therefore you're just trying to keep imports out. The McKinley tariffs raised the rate of imports on growing American industries. Wool, fabrics and yarn, and especially tin plate, which was used for just about everything back then. As McKinley put it, the point was to make the cost of foreign tin plate high enough to insure its manufacture in this country.

It worked. Tin plate prices did go up at first, because that's what happens when you raise tariffs. But so did U.S. production. It boomed. Meanwhile, tin plate imports went down. And so this gave tariff proponents a great success story to point to. The protective tariff policy of the Republicans has been made and made the lives of our countrymen sweeter and brighter. And those fewer imports meant that the other goal was accomplished, too. It lowered tariff revenue, which lowered the surplus.

But then, most of the 1890s, we were mired in this recession. It had more to do with being on the gold standard than the tariffs. But the tariffs affect voters directly. They see prices go up in people's minds. It was associated with that. And so they punished the Republican party. As a result, Republicans lost the 1892 midterms badly. Even McKinley was out of office after a stint as Ohio governor, he won the 1896 presidential election.

And as president, McKinley began to think about using tariffs for their third reciprocity. He had Congress, as part of another tariff package, give him the authority to reduce tariffs on just a few items so he could negotiate trade agreements. I'll lower my tariffs if you lower yours. By the end of his first term, the economy was dramatically different from when he was a congressman. Manufacturing output of US industries was rising fast and the US was taking in less than half of its revenue from tariffs.

World economy is beginning to undergo a boom. American manufacturers, they're really good. They've sort of saturated the domestic market. And so we need foreign markets to sort of vent our surplus. And you're not going to export to the world if you're a very closed, protected economy. You have to open up. By his second term, he believed that was the future. At the big Pan American exposition in Buffalo, New York, McKinley gave a surprising speech to a crowd of tens of thousands.

The former self described tariff man said, the period of exclusiveness is past. reciprocity treaties are in harmony with the spirit of the times. Measures of retaliation are not. If purchased by chance. Some of our tariffs are no longer needed for revenue or to encourage and protect our industries at home. Why should they not be employed to extend and promote our markets abroad? So what he's basically saying there is that we don't need the revenue so much and we don't need the protection against foreign competition. Why can't we use the tariff as a way of inducing other countries to open up their markets and achieve reciprocity?

For him to propose this is really a dramatic step. We'll never know if he would have followed through and made more trade agreements. The very next day he was shot by an anarchist and later died. Vice President Teddy Roosevelt took office. Theodore Roosevelt didn't have as strong views on the tariff as McKinley did. He wasn't as much of an expert and he didn't push the way McKinley, I think, would have pushed for this new direction in trade policy. Just a decade later, Democrats switched to an income tax system and tariffs were used sparingly, really just for restrictions on small, specific industries.

But now tariffs are back. The tariffs are going to make us very rich and very strong. President Trump has said he plans to use tariffs for all three Rs and we will use the hundreds of billions of dollars in tariff dollars to benefit the American citizens and pay down our debt. We will make our own products. We will buy far less from foreign countries than we are buying right now, but we're going to have a reciprocal tax, we're going to charge them the same.

But these objectives can't all be accomplished at once. If you really want to restrict imports, keep them out of the US Market, well, you can't really use that as a bargaining chip. And if you're trying to raise revenue, you can't have the rates too high and restrict access to the market because revenue is based on imports coming in. So you can't really achieve all three at the same time.

The White House didn't comment on where Trump's fascination with McKinley began, but said the president is reviewing his options of balancing increasing revenue while restricting imports. But tariffs have never been used at a McKinley level in a modern day economy. Today we have integrated supply chains where all the component parts and the component raw materials are part of this very complex multi country movement. And so tariffs are a little bit more disruptive today, perhaps a lot more disruptive today because there's so many chains to international commerce.

Now Trump might take the mantle as the new tariff king. And he I don't think he was as bad as I am. I think I believe in him even more than him.

POLITICS, ECONOMICS, HISTORY, WILLIAM MCKINLEY, DONALD TRUMP, TRADE POLICY, THE WALL STREET JOURNAL