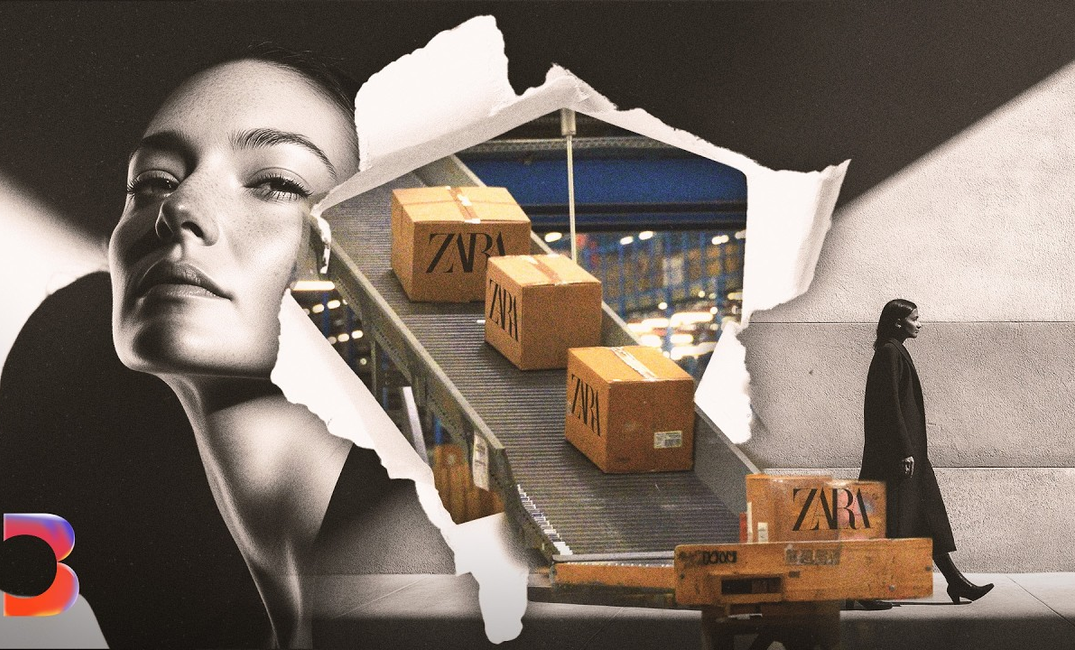

The video examines the unique and somewhat enigmatic business model of Zara, the largest company in Spain, and highlights its unconventional strategies amidst rising global competition and existential challenges for the fashion industry. It delves into Zara's origins as a pioneer of fast fashion and its global influence, explaining Zara's minimal reliance on advertising in favor of distinctive promotional techniques.

The video further details Zara's substantial logistical operations which differentiate it from competitors by emphasizing proximity production and rapid distribution. It showcases how Zara adapts quickly to consumer trends by keeping design and production cycles swift and agile, allowing them to stay ahead of fashion fads and weather challenges better than many rivals. It also describes Zara's approach to store management and its expansion-driven response to e-commerce competition.

Main takeaways from the video:

Please remember to turn on the CC button to view the subtitles.

Key Vocabularies and Common Phrases:

1. enigma [ɪˈnɪɡmə] - (noun) - Something difficult to understand or explain; a mystery. - Synonyms: (mystery, puzzle, conundrum)

These are the inner workings of Zara, a successful enigma full of contradictions.

2. existential [ɛɡzɪˈstɛnʃəl] - (adjective) - Relating to existence, especially human existence. - Synonyms: (ontological, philosophical, fundamental)

And as the global fashion industry confronts new competition and existential problems, can it last?

3. proximity [prɒkˈsɪmɪti] - (noun) - The state of being near in space or time. - Synonyms: (closeness, nearness, adjacency)

But more than half of their production comes from what they call proximity, that it be markets closest to its headquarters.

4. fragmented [ˈfræɡmɛntɪd] - (adjective) - Broken into pieces; not continuous or cohesive. - Synonyms: (disjointed, fragmented, scattered)

One thing that's unique to the apparel industry is that it is extremely fragmented.

5. reckoning [ˈrɛkənɪŋ] - (noun) - The act of calculating or judging something. - Synonyms: (calculation, estimation, assessment)

The retail fashion landscape is undergoing a moment of reckoning.

6. churn out goods [tʃɜrn aʊt ɡʊdz] - (phrase) - To produce something in large quantities, often quickly and mechanically. - Synonyms: (mass-produce, generate, manufacture)

Fast fashion is the ability for retailers to respond to changing consumer trends and quickly churn out goods with a very short lead time.

7. distinguish [dɪˈstɪŋɡwɪʃ] - (verb) - To recognize or treat as different. - Synonyms: (differentiate, discern, separate)

Rivals like Sheen and Timu is pushed Zara to essentially try and find different means to distinguish itself.

8. agile [ˈædʒaɪl] - (adjective) - Able to move quickly and easily; nimble. - Synonyms: (nimble, quick, lively)

This allows them to be very swift, very agile, very nimble in how they produce and what they produce.

9. logistics [ləˈdʒɪstɪks] - (noun) - The detailed organization and implementation of a complex operation. - Synonyms: (planning, coordination, management)

The biggest difference between Zara and its rivals, though, is its approach to logistics.

10. environmental impact [ɪnˌvaɪrənˈmɛntəl ˈɪmpækt] - (phrase) - The effect that a particular action or entity has on the environment. - Synonyms: (ecological effect, environmental influence)

They have also changed the bar for environmental impact.

Inside the Secret World of Zara

These are the inner workings of Zara, a successful enigma full of contradictions. It is by far the biggest company in Spain, drawing inspiration from the glitz of the Runway. You might expect headquarters in Madrid, one of Europe's glamorous capitals. But nope, it's right here in this rural corner of northern Spain. And in an industry married to glossy, full page campaigns and costly commercials, the company's ad spend is basically non existent.

So what's making this work so well for Zara? And as the global fashion industry confronts new competition and existential problems, can it last? The retail fashion landscape is undergoing a moment of reckoning. 5678 and switch. Zara is widely considered the creator of fast fashion. That was a label given to them by the New York Times when they opened a Zara store in New York. Fast fashion is the ability for retailers to respond to changing consumer trends and quickly churn out goods with a very short lead time.

Trendy threads which usually cost little enough that it doesn't matter if you only wear it for a couple of lunches or a single evening alone squatting on a stove. Some people would say that H and M did the same thing. But given the size and the presence globally of Zara, there's a lot of people who would argue that they are definitely the one who gets the crown. It's for those aspirational luxury shoppers who can't afford to buy top tier brands or even mid tier brands. And they're for the shoppers who want to look stylish, look chic, but can't consistently afford those higher priced labels.

Zara is one of several brands owned by Inditex, the publicly traded parent company created by the tycoon Amancio Ortega. At the end of September, it was valued at $183 billion, with brands in more than 200 markets. But make no mistake, Zara runs the show. It's the brand that gives the name recognition to Inditex as a whole. When you look at the six top brands, which is Zara, Massimo Dutti, Stradivarius, Oiso, Columbair and Bershka, Zara represents about 70% of overall sales.

And the company's approach has changed the way we shop. In the last two decades, clothing production has roughly doubled, while the global population has increased by 30%. In short, people are buying more clothes, wearing them for shorter periods, then repeating the process with any of a swelling number of businesses, with devastating consequences for the environment. Which, don't worry, we're going to come back to one thing that's unique to the apparel industry is that it is extremely fragmented. Nowhere in the world will you find a huge company that has a huge, huge market share. Everyone seems to have very, very low market shares, 1%, 2%, 3%. And so there is space for many big players.

So what makes Zara different? First, there's its unconventional approach to marketing. There's no advertising, basically, definitely not traditional advertising. We think marketing is under 1% of sales. For inditex, a typical fashion retailer, you'd be looking at marketing spend of somewhere between a low to mid single digit proportion of sales. So, you know, materially higher over the years. One thing that has helped is that the name has become popular and you have high profile figures who wear the brand. A clear example is the queen of Spain, who sometimes wear Zara.

It's interesting given that it's not a luxury brand. And then there's Zara's often bizarre promotional imagery and product shots. They're trying to capture the feeling that a shopper gets when they try on a coat. It makes them perhaps feel snug and warm, and they want to capture that through their more editorialized photos on their website. Have you ever personally thought that a jacket would look better on you if you wore it backwards? Not yet. But, you know, there's always a first for everything.

The biggest difference between Zara and its rivals, though, is its approach to logistics. Most sportswear companies and apparel companies in the world have become, over the years, extremely reliant on factories in Asia, Bangladesh, Pakistan, Vietnam and China, among others. Zara has also started producing over the years in those countries. But more than half of their production comes from what they call proximity, that it be markets closest to its headquarters. So Spain, its home market.

And here and here and here. And what that allows for is much more rapid distribution into stores. So we think about 80% of stores within Inditex can have a shipment every four to five days. The second part of their uniqueness in logistics is that everything they produce gets shipped back to distribution plants in Spain, like this one near Madrid. Every Zara item you've ever worn once came here. Those products get repackaged and then they get sent out to stores across the globe based on the needs from those stores.

This adaptability helps the brand navigate a competitive retail landscape. Which brings us to stores. Take a look at this chart. While Inditex, along with the rest of the industry, closed some during the pandemic, the pace has now slowed. But look at the other line. This shows its retail floor space. And that has started to rise, meaning the stores are getting bigger. Part of the reason has been because of the rise of e commerce. Rivals like Sheen and Timu is pushed Zara to essentially try and find different means to distinguish itself.

It's allowing customers to go in and try their offerings, try on their clothes and have more of a personal interaction with their products, rather than just viewing it online like a catalogue as to what makes it onto hangers and rails. That's the function of another area. At Zara HQ, product store managers, each of whom are responsible for a small number of units in a particular region. And what they are trying to do is constantly understand in real time, the trends that are coming out, the demand that they're seeing, you know, what is popular.

They're feeding back that information and trying to synthesize what they see as the global trends of the moment. That information is then being passed on to the designers and to the buyers. They basically have about six weeks from the moment they start designing a product till the moment that product is in a store. This allows them to be very swift, very agile, very nimble in how they produce and what they produce. It helps them adapt to fashion trends. It also helps them adapt to weather changes in 2024.

That last part was really important, at least to one of Zara's biggest competitors, H and M. The swedish retailer is blaming poor sales at the start of June due to bad weather. If you look at the revenue for both companies since COVID you'll see Inditex has consistently outperformed, regardless of meteorological events. The biggest challenges for Zara and the industry as a whole are twofold. The rise of chinese fast fashion powerhouses and fast fashion's devastating effect on the planet.

What is beyond debate is that these companies, like Shein and Temu, have made inroads, especially in the US, and have changed the bar of comparison for Zara. Zara now has to keep an eye on those, because these are the brands that are being installed and being seen as the go to place for a lot of consumers, especially at the lower end of the age groups. They have also changed the bar for environmental impact. Right. They're not public companies in the way a publicly traded company company like Zara or HM Namis, and so they also have less responsibility towards stakeholders like investors on their environmental practices.

And that, in a way, has changed the pressure a company like Zara has. So fast fashion undoubtedly has an impact on the environment. The raw materials that are used in fast fashion are incredibly water intensive. Energy intensive fashion is responsible for 20% of the 300 million tonnes of plastics produced each year. In the time it's taken you to get to this point of the video, look how many items of clothing were thrown away or destroyed in the US alone.

This equates to 10 billion waste a year. Given the sheer volume that is produced by retailers like Zara, it undoubtedly will impact its environment. It's also been criticised as promoting overconsumption and a culture of waste. So throwing away your clothes after just a few uses and one of the ways that retailers are looking to push back against this negative image is by creating all sorts of pledges. So Zara, for example, has pledged to reach net zero emissions by 2040, and it's also introduced a repair service.

But the question is whether or not that is enough to offset the sheer volume of clothes that it churns out on a yearly basis. That's one of the key challenges for Marta Ortega, who became Inditex's non executive chairwoman in 2022. Shes been central to Zaras business strategy, specifically in its high end initiatives and Zara woman. But to prosper and continue her fathers legacy in the company, Shell need to evolve her playbook to address intensifying pressure, fueled in part by the groups decades of success.

Business, Innovation, Global, Zara, Fast Fashion, Sustainability, Bloomberg Originals