The video discusses the aftermath of Hurricanes Helene and Ian, focusing on the insurance controversies faced by Florida residents. Homeowners like the Rapkin family have struggled with inadequate insurance payouts and altered damage reports. Their experience highlights a disturbing trend where insurance companies allegedly deceived policyholders by altering claims to reduce payouts, leading to numerous lawsuits and accusations of fraud.

Through interviews with insurance insiders and adjusters, the video uncovers systemic practices where insurance carriers allegedly altered reports to minimize damage assessments. Whistleblowers reveal these changes, often made by company-hired desk adjusters who had never seen the properties. The video emphasizes how this has left many families unable to afford repairs, despite paying premiums.

Main takeaways from the video:

Please remember to turn on the CC button to view the subtitles.

Key Vocabularies and Common Phrases:

1. landfall [ˈlandˌfɔːl] - (n.) - The point at which a storm or hurricane moves over land from the sea. - Synonyms: (coastfall, landing, arrival on land)

On Thursday night, Hurricane Helene and its 140 miles an hour winds made landfall in Florida's Big Bend region.

2. whistleblower [ˈhwɪsəlˌbloʊər] - (n.) - A person who informs on another or makes public disclosure of corruption or wrongdoing. - Synonyms: (informant, tattler, snitch)

The whistleblowers, who are all licensed adjusters, tell us after Hurricane Ian, several insurance carriers were using altered damage reports to deceive customers.

3. daunting [ˈdɔːntɪŋ] - (adj.) - Seemingly difficult to deal with in prospect; intimidating. - Synonyms: (intimidating, formidable, unsettling)

...residents know rebuilding after the storm is likely to be as daunting as the storm itself.

4. altered [ˈɔːltərd] - (v.) - Changed or modified, in this context often to mislead or deceive. - Synonyms: (modified, changed, adjusted)

The whistleblowers, who are all licensed adjusters, tell us after Hurricane Ian, several insurance carriers were using altered damage reports to deceive customers

5. daunting [ˈdɔːntɪŋ] - (adj.) - Seemingly difficult to deal with in prospect; intimidating. - Synonyms: (intimidating, formidable, unsettling)

...residents know rebuilding after the storm is likely to be as daunting as the storm itself.

6. deductible [dɪˈdʌktəbl] - (n.) - A specified amount of money that the insured must pay before an insurance company will pay a claim. - Synonyms: (excess, contribution, out-of-pocket cost)

And so the deductible was taken out

7. breach of contract [briːtʃ əv ˈkɒntrækt] - (n.) - A failure to perform some contracted or agreed-upon act or service. - Synonyms: (violation, infringement, default)

Jeff and Ginny Rapkin filed a lawsuit against Heritage accusing it of breach of contract and fraud.

8. manipulating [məˈnɪpjuleɪtɪŋ] - (v.) - Controlling or influencing a person or situation cleverly or unscrupulously. - Synonyms: (maneuvering, exploiting, operating)

I now have evidence in six different states of where carriers are manipulating the estimates...

9. transparency [trænˈspɛːrənsi] - (n.) - The condition of being see-through, in context meaning openness, clarity. - Synonyms: (clarity, openness, accountability)

Yeah, there's almost no transparency in the claims process.

10. advocacy [ˈædvəkəsi] - (n.) - Public support for or recommendation of a particular cause or policy. - Synonyms: (support, promotion, backing)

Doug Quinn is the executive director of the American Policyholders association, an advocacy group he started after his home was destroyed by Hurricane Sandy in 2012.

Florida insurance carriers used altered hurricane damage reports, whistleblowers say

On Thursday night, Hurricane Helene and its 140 miles an hour winds made landfall in Florida's Big Bend region. It was deadly. The full extent of the damage won't be known for weeks, and residents know rebuilding after the storm is likely to be as daunting as the storm itself. It's been two years since Hurricane Ian hit southwest Florida, and an estimated 50,000 homeowners are still locked in battles with their insurance companies.

Tonight, you will hear from insurance insiders who say after years of diligently paying premiums, homeowners are being misled by their insurance carriers. The whistleblowers, who are all licensed adjusters, tell us after Hurricane Ian, several insurance carriers were using altered damage reports to deceive customers. The story will continue in a moment, as Hurricane Ian slammed into Florida with 150 miles an hour winds. Jeff Rapkin took this video from the porch of his home about 40 miles south of Sarasota. All the trees are coming down. They don't normally look like this. Everything's coming apart. My name is Jeff Rafkin. I live in Northport, Florida.

Rapkin, an adoption attorney, and his wife Ginny, raised three children in this home and weathered more than a half dozen hurricanes inside it. But Ian, they say, was different. It just, it sat above our heads. It wouldn't move. I mean, it was a nightmare. And it went on for how long? 11 hours. 11 hours. It felt like the hurricane was inside the house. We couldn't keep the windows closed. That is the Rapkins house. A neighbor just happened to be filming when their steel roof was ripped off. When the storm finally passed, the Rafkins could see clear skies through the new hole. Hurricane Ian punched in their ceiling. There were trees on and around their house. The roof was shredded and everything inside was soaked.

The Rapkins lined up their losses on the curb and called their insurance company, Heritage, to begin the claims process. It sent a licensed adjuster to the house to assess the damage. Did you get the feeling, speaking to him and showing him around the property that he understood? Oh, yeah. Yeah. What was happening here. This was serious. He was really nice. He was thorough. And he said, your house is probably going to need to be completely rebuilt. Which is why the Rapkins were floored. When they finally got a check from their insurance company three months later, they sent us a report from the adjuster which said that it would cost $15,000 to put our home back to pre hurricane county conditions. They sent you $15,000. $15,000. And so the deductible was taken out. So it was $10,000 and then our public adjuster took $1,000 out, so we had nine.

When you called and said $9,000, are you kidding me? What was the reaction? The reaction was, this is the decision we've made. And I started to pray for Mister Jordan Lee's untimely demise because I was so angry. We found Mister Jordan Lee very much alive. Do you remember the Rapkin family? Yes, ma'am. Lee is the adjuster who went to the Rapkins home after the storm. What do you remember about them? Their property, a two story home, metal roof that was blown off by Hurricane Ian. And the interior of the home was just. It was soaked. Jordan Lee has been a licensed adjuster in Florida since 2017 after major disasters.

Most insurance companies use third party firms who hire adjusters like Lee to help them with the thousands of claims. Lee says after he assesses a home, he always leaves his cell phone number with the homeowners so they can call him if they have any questions. After Hurricane Ian, homeowners did. What were they saying? Cussing me out left and right, up and down, you know, how could you do this to us? It was really bad, actually. And out of the. The thousands of claims that I've handled, I've never had phone calls like that. Confused, he went back to compare the damage report he wrote for the rapkins to the one the insurance company sent to them.

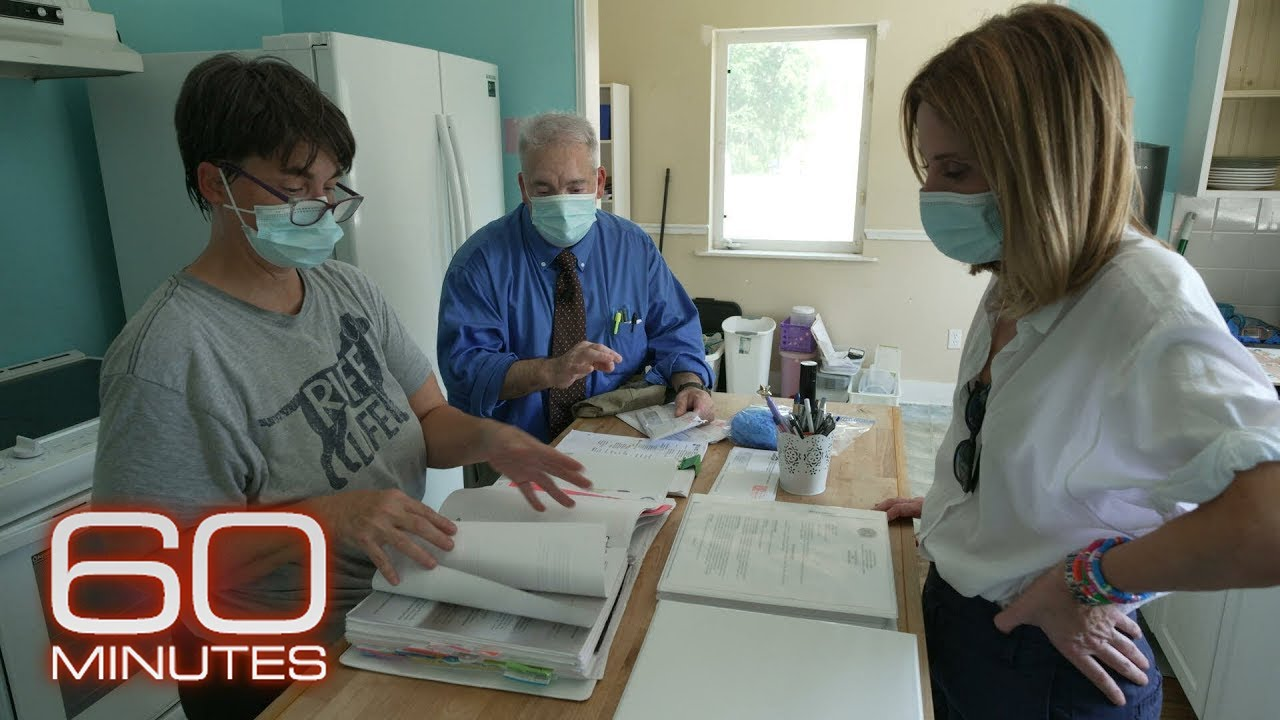

That's your work. Correct. And this is what they were given. It's totally different. Totally different. You said they needed a new roof. I did. And this report says what it reads as a repair. Was that roof able to be repaired, in your opinion? Not in my opinion, no. Later, Jordan Lee learned a desk adjuster whod never been to the Rapkins home had deleted entire sections of his report, but left his name and his license number on it, making it look like his work. Did anybody ever alert you, hey, were making a change to this report? No, nobody told me. The only way that I knew was the homeowner calling me.

It is standard procedure for field adjusters to collaborate with those back in the office to make minor edits. But Jordan Lee says that is not what happened with the Rapkins report. Did you put a dollar amount on how much you thought they were owed? $231,368.57. Judge. What did the insurance carrier come up with? $15,469.48. So quite a bit of difference. That's not a difference of opinion? No. Jordan Lee says as he dug further into his work from Hurricane Ian, he was stunned to discover the Rapkins weren't the only family whose report was altered. It was basically all of them. I mean, I handled 46 of them. 44 of them were changed.

Were any of your reports changed to give the policy owner more money? No, it was always down. It was always down. Down by as much as 98%. One estimate he wrote for $488,000 was changed to 13,000, another from 239 to 3000 on December 13, 2022. My name is Jordan Lee. I'm an independent insurance adjuster and I work for the insurance companies. Jordan Lee and two other adjusters testified to Florida lawmakers about what one watchdog group called systematic criminal fraud by the insurance companies. The scheme was repeated over and over again, not only on my estimates, but on estimates written by other adjusters. Ben Mandel has been a licensed adjuster since 2017. He did not work for heritage, but says 18 of the 20 reports he wrote for another carrier after Hurricane Ian were altered.

And he says he and other adjusters were instructed by some of their managers to leave damage off reports. It was a deliberate scheme to do this, and it wasn't just with one carrier doing this. This was six carriers that we discovered were doing this in the state of Florida. They all got the memo. Which was? Which was, we're not going to replace roofs, asphalt shingle roofs. We're not going to replace them, we're going to repair them. Mandel says he refused to leave off roofs. They were asking me to do something that was illegal. And why was it illegal? It's illegal because when I go out to make a damage estimate, I have to put what the damage is, not what they want the damage to be. And so if I leave something off that's supposed to be on there, I can be prosecuted for that.

So the company is telling you leave the roofs off, we're not paying for roofs, but you keep writing these roofs. That's correct. I wrote the way they're supposed to be and you get fired. And I got fired. Now Ben Mandel and five other whistleblower adjusters are represented by attorney Stephen Bushden. Bush worked as a public adjuster for more than a decade. What the carriers are doing, in some instances, what they've said was, if the policyholder needs a new roof, then we're going to make them make us pay. In other words, file a lawsuit and then we'll pay you for your roof. But unless they do that, they're not getting the roof paid for. They're not getting it. They're not getting it. Most people will not stand up and fight I cannot tell you how many people come to me and say, hey, what was I going to do?

I had to replace my roof. And do you think the insurance companies know that they're betting on that? Most people are just going to roll over, no question they know that they're playing the odds and they're winning. Florida's insurance market has been a risky gamble for years. After a decade of costly storms, several national carriers exited Florida. Smaller regional carriers stepped in, but not all were up to the job. Since 2021, at least nine insurance companies in Florida have collapsed, and some of the remaining ones, Stephen Bush says, alter damage reports.

And is it just in Florida? I now have evidence in six different states of where carriers are manipulating the estimates, changing them, and then misrepresenting to policyholders that it's the work product of the field adjuster. And do most times the policy owner have any idea? They say policy owner has no clue. Yeah, there's almost no transparency in the claims process. Doug Quinn is the executive director of the American Policyholders association, an advocacy group he started after his home was destroyed by Hurricane Sandy in 2012. The victims of insurer fraud are the last people to find out that they were victims of insurer fraud. So when the insurance carriers say, look, it's our right, we're allowed to go back in there and do what we want to. These are adjuster reports.

You would say you are not allowed to take somebody who has dutifully paid premiums for years and when they need their insurance, cheat them and shave 70, 80, or 90% off their claim. You are not allowed to do that. You are allowed to disagree with, you know, the minutiae. But coming in to that degree and faking the facts on a claim is not acceptable, and there should be legal consequences for that. If you really want to see change in the industry, put somebody in handcuffs. Attorney Stephen Bush says he turned over what he says is evidence of insure fraud to state investigators, and Florida opened a criminal investigation.

But two years after the storm, Florida's made no arrests. We know fraud's investigated all the time when it comes to homeowners, right? You know, if you put in a false contractors and public adjusters, everybody who's aligned to with the consumer, who costs the insurance industry money, those cases get investigated and prosecuted rather quickly and aggressively. All we are asking is that cases that are alleged to be perpetrated by the insurance carriers or the vendors that they hire are just as aggressively investigated and prosecuted when fraud is found, Quinn says it's difficult to know how many policyholders may have been given less money than they were owed.

But two years after the storm, every unrepaired home and tarp tells a story. At the Rafkins, mold and Mother Nature are gnawing away at what's left of their home and upstairs. Oh, thanks. All right. Oh, well, there's the sky. Tisn't a hole. This is a crack down the middle of your house. I can put my whole arm up through here. That split roof is an open wound for the Rapkins, who still have to mow the lawn and make mortgage payments on their rotting home every month. They're also paying rent on an apartment nearby and $4,000 a year to heritage for home insurance.

And you're still paying? I'm still paying. Oh, yeah. The premiums went up, so we're still paying. We're still paying. And the premiums went up and I can't get another insurance company, obviously. Jeff and Ginny Rapkin filed a lawsuit against Heritage accusing it of breach of contract and fraud. In a statement to 60 Minutes, Heritage said it couldn't comment on specific policyholders, but aims to pay every eligible claim and had no intention to deceive. The company says in its own random sample, about 42% of damage reports were revised downward and 26% were revised upward. Heritage says that since Hurricane Ian, it has made many reforms, including updating its claims processing software, which it blames for not including the names of desk adjusters who altered reports.

Do you think that was a mistake, just an innocent mistake? Originally I did. I said, oh, maybe they made an error. And what do you think now? I think they did it on purpose. And I think people are getting letters that say they're not covered when they are. This is a con. That's what this is. This is make them go away at all costs. We're not paying.

Hurricane, Insurance, Fraud, Economics, Leadership, Global, 60 Minutes