The video transcript chronicles a discussion with Vinod Khosla about the rationale behind investing in the Open AI startup. Khosla outlines his optimism regarding the broad societal impact of AI over the next decade and emphasizes his duty as a long-term investor to venture into projects with substantial future influence and return potential. He dismisses any speculation about Open AI gearing up for an ipo, though he acknowledges discussions about potentially shifting the company's structure to raise more funds as needed.

Khosla addresses Open AI’s rapid revenue growth and team changes, pointing out the company’s formidable technical prowess and its blitz-paced product development. Additionally, the conversation delves into Khosla's viewpoints on AI's ability to extend wealth to more people globally, considering both dystopian criticisms and the vast potential AI harbors for societal good. He expresses confidence in Open AI's leadership and its position as a prominent player in the sector.

Main takeaways from the video:

Please remember to turn on the CC button to view the subtitles.

Key Vocabularies and Common Phrases:

1. rationale [ˌræʃəˈnæl] - (noun) - A set of reasons or a logical basis for a course of action or belief. - Synonyms: (reasoning, grounds, explanation)

What was the rationale behind participating in this round?

2. fiduciary [fɪˈduːʃɪˌɛri] - (adjective) - Relating to the trust or responsibility held by a trustee for the benefits of another party. - Synonyms: (trustee, custodian, guardian)

You have a fiduciary duty to your LPs and you are a long term investor.

3. ipo [aɪ piː ˈoʊ] - (noun) - Initial public offering, the first time that the stock of a private company is offered to the public. - Synonyms: (stock market launch, flotation, public offering)

And many people in the Bloomberg Technology audience say, Ah, does Vinod Khosla sense that an ipo is coming for the open AI?

4. utopian [juːˈtoʊpiən] - (adjective) - Modeled on or aiming for a state in which everything is perfect; idealistic. - Synonyms: (idealistic, perfect, paradisiacal)

Then last month you wrote in your blog a piece titled I dystopian or utopian.

5. dystopian [dɪsˈtoʊpiən] - (adjective) - Relating to an imagined state or society where there is great suffering or injustice. - Synonyms: (bleak, grim, nightmarish)

Then last month you wrote in your blog a piece titled I dystopian or utopian.

6. blitz [blɪts] - (noun / verb) - An intense or sudden military attack; also used informally to describe any intensive or sudden effort or endeavor. - Synonyms: (onslaught, offensive, surge)

The company has been producing products at a blitz rate kind of pace.

7. consternation [ˌkɒnstərˈneɪʃən] - (noun) - Feelings of anxiety or dismay, typically at something unexpected. - Synonyms: (dismay, distress, alarm)

There was some consternation that within the documentation there was a push that anyone who backs open air can't back its competitors in the future.

8. equitable [ˈɛkwɪtəbl] - (adjective) - Fair and impartial. - Synonyms: (fair, just, even-handed)

It's the most important tool they've had in human history for creating abundance and creating a fairer, more equitable, more well-off society.

9. abundance [əˈbʌndəns] - (noun) - A very large quantity of something. - Synonyms: (plenty, wealth, profusion)

I then talk about the abundance it can provide.

10. perspective [pərˈspɛktɪv] - (noun) - A particular attitude toward or way of regarding something; a point of view. - Synonyms: (viewpoint, outlook, stance)

So the perspective you should take is years of growth in a normal start up in two years and drop growth, you would see expect to see changes internal as well.

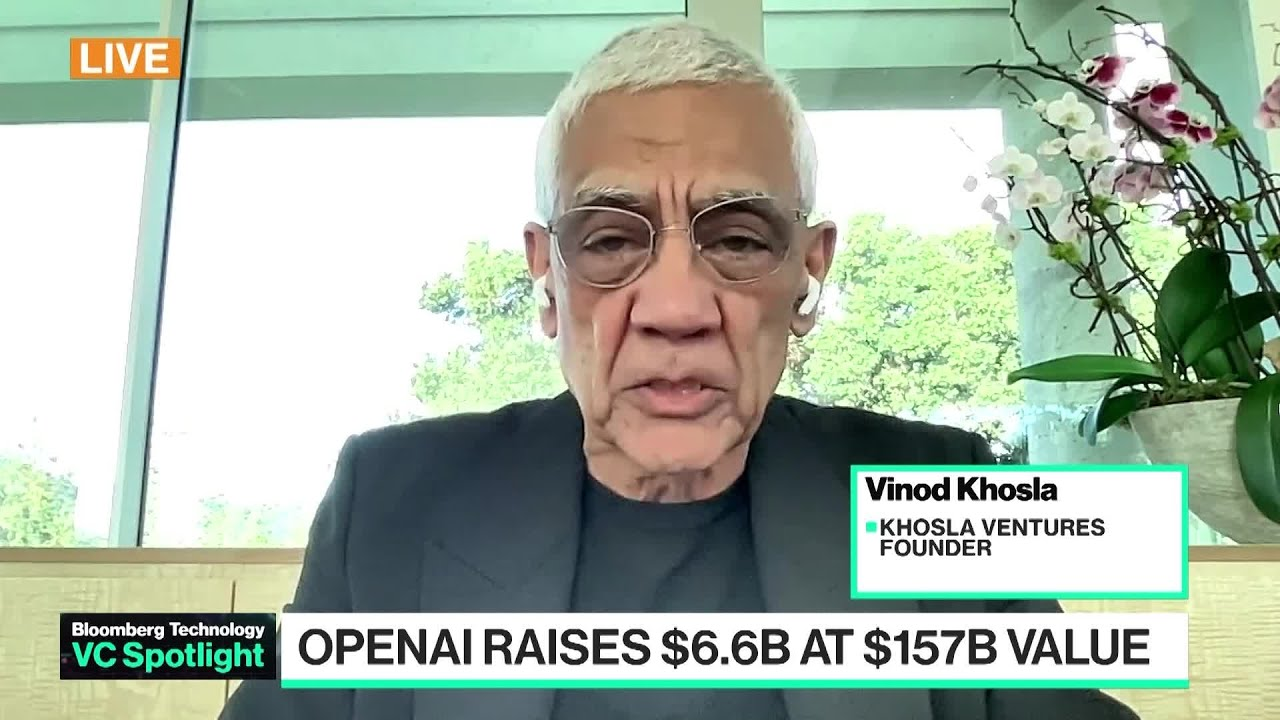

Khosla on OpenAI's Mega Round, Leadership in AI Space

We've discussed many times. You wrote the first check into Open Eye. What was the rationale behind participating in this round? And we've gone over the numbers, how big they are and why it is historic. Well, the reason to participate is because I'm pretty optimistic about the impact I can have in all parts of society. It's very, very large over the next ten or 15 years. So if you're a long term investor as I am, it makes sense. You have a fiduciary duty to your LPs and you are a long term investor.

And as always, I always put on social media that you're coming on the show. And many people in the Bloomberg Technology audience say, Ah, does Vinod Khosla sense that an ipo is coming for the Open AI? And so he's got into this round in preparation for that. We haven't discussed an ipo. The structure today isn't set up for an ipo. Let's talk about that structure. Have you been discussing turning into a B Corp, deciding to be more for profit? Well, Sam has publicly discussed changing the structure without talking about the specifics. And that's probably all I can say. I think it's a good idea for this company to set up, but to be set up to raise more money when needed.

I think the way of perspective on opening, I think over the last two years, 20 years of rapid growth in revenue into two years, when you have that kind of growth from almost no revenue to billions of revenue, as it's been reported, you want to be set up and you will need to consume capital, especially in data centers and some other training center, those, etc. So the perspective you should take is years of growth in a normal start up in two years and drop growth, you would see expect to see changes internal as well. How have you felt about the fact that the founding team that you first invested in looks very different now from the team that leads the business apart from some? Well, I think the team looks different, but it's a very strong technical team and what has been happening is streamlining it for rapid movement.

As you know, the company has been producing products at a blitz rate kind of pace. Very few competitors have been able to keep up with the wide range of products and really significant capability that the company has developed. And I think the key in this race is to beat the competition, not worry about others, and frankly, to grow revenue very rapidly and which, as you said, is very rapidly. Then last month you wrote in your blog a piece titled I dystopian or utopian. I read it. It's a long read, but in conclusion, you see a path to AI unlocking wealth that is basically held by less than a billion people being extended to nearer to seven 8 billion people through AI. The bit that was missing from the piece I felt is how it is open.

I get us that you are very focused on open air guest as a leader in getting human access to artificial technology, artificial intelligence technology. Forgive me. Mm hmm. Well, at. What I spoke to in this piece is I in addressed some of the critics concerns about the dystopian things that might happen. I'm not saying there's no risk, but I addressed all of them here in specifically and then talk about the abundance it can provide. It's the most important tool they've had in human history for creating abundance and creating a fairer, more equitable, more well-off society. The company that wins and I will lead this race.

I suspect more than one player will be participating. So it's not just opening I but I'm very, very bullish opening. I is executing extremely well on product, which is what matters and on revenue growth. So I'm excited for opening I as being a leader, but probably one of the leaders in this space. To be a leader. Do you think Sam should take equity himself in the company? That's for the board to decide. I do think Sam deserves something for what he's done, but it's not his highest priority. You know, it's far from his highest priority.

V.A. What is your assessment so far of Sarah Friar? My understanding, standing speaking to some of your peers and colleagues in industry is that she prepared a pretty straightforward presentation that tried to educate those that didn't have as clear an understanding of the path forward in business model. And actually, a lot of investors got it. They looked at the presentation and went, okay, we're on board with this. What was your reaction to her into that? Well, I've known Sarah for a long time. I was on the border square now block when she was CFO there.

So I've had a long relationship with Sarah. She you're exactly right. She prepared a crisp presentation. It was simple, straightforward, said, here's where we are today. Here's where we expect to be a year from now. Much more than that is not that predictable interest. Compelling. Obviously, it was compelling to me. Otherwise we wouldn't have invested that. And what's interesting is you say, look, it won't be the only one, but you want it to be the leading player.

There was some consternation that within the documentation there was a push that anyone who backs open air can't back its competitors in the future. Is that normal? Is that something that you want to see in such documents? You know, in very large bags. This is pretty normal. And it isn't a requirement. It's not a legal commitment, it's a mutual understanding. And we operate a lot on trust. So investors committed to get behind open the eye and not its competitors. And that's pretty normal, especially at this scale.

Then I'd like to end our conversation by just talking about technology. Every day I have a conversation, we chat GPT for a voice input or I talk to matter A.I. through the Ray-Bans and sometimes my wife looks at me baffled and or in the street in San Francisco or my colleagues here in the bureau. And I say all that to ask the question of when you think the tipping point is the large body of people out there, AI to understand how they're supposed to be using this daily or believe that they should be using it daily. Well, and I put my email address on my business card in the eighties and had dinner with my business school friends. They laughed at me all night, so I'm familiar teng's.

I'm wearing AirPods, which would have seemed strange and years ago, but so people do adjust it. Some people adjust faster. I think what the question you have to ask is chatty, pretty useful to you, and it's extremely useful to me in a wide range of tasks and yeah, generally useful to me very broadly. Even my Tesla driving is incredibly valuable to me, so that's all I need. So focus on what's useful, not the perception of it. And in the end it'll spread everywhere if it's actually useful to more people. Quick last on. What's your favorite thing currently to use? Chachi Beautiful. Oh, wide range from falling scientific stuff. I participated in a scientific meeting there. I didn't have a background. It was extremely useful in interpreting things that were being said for me. I also used it to design my garden.

Artificial Intelligence, Technology, Innovation, Open Ai, Venture Capital, Investment, Artificial Intelligence, Caroline Hyde, Ed Ludlow, Openai Inc, Vinod Khosla, Bloomberg Technology