The conversation begins with Jeff Green, a real estate and financial investor, sharing his political background and his Democratic-leaning stance owing to his belief in equal opportunity provided by government support in sectors like education and healthcare. Despite supporting Democratic policies, Green acknowledges the merits of the Republican platform and expresses hopes for unifying leadership under Donald Trump. He discusses the political climate in Florida, noting a shift in voter registration that gives Republicans a distinct advantage.

Jeff Green shares insights into the economic landscape, particularly concerns over the U.S. national debt and its potential ramifications on the economy. He critiques the lack of discussion around national debt reduction in political campaigns and suggests a combination of tax adjustments and expense cuts without neglecting essential public needs. Green anticipates regulatory changes under Trump's presidency, potentially benefiting entrepreneurs and business growth, while emphasizing the importance of addressing the national debt to avoid future economic issues.

Main takeaways from the video:

Please remember to turn on the CC button to view the subtitles.

Key Vocabularies and Common Phrases:

1. leanings [ˈliːnɪŋz] - (noun) - A tendency to have a certain viewpoint or to favor a particular political or social ideation. - Synonyms: (tendency, inclination, predisposition)

Well, I mean, generally, most of my Democratic leanings since growing up in Massachusetts, most of my political leaning since growing up in Massachusetts have been Democratic.

2. dispersed [dɪˈspɜrst] - (verb) - To distribute or spread over a wide area. - Synonyms: (scatter, spread, diffuse)

And you know, I've always felt that talent is, you know, is evenly dispersed among all people all over the world, regardless of their race or their age or their nationality.

3. distributed [dɪˈstrɪbjuːtɪd] - (verb) - Spread or allocated across various areas or among many people. - Synonyms: (allocated, dispensed, apportion)

But what's not evenly distributed is opportunity.

4. entitlement [ɪnˈtaɪtəlmənt] - (noun) - A government program providing benefits to members of a specified group; the right to benefits granted by law. - Synonyms: (right, privilege, allotment)

We all know that half of the six and a half trillion or whatever the budget is, is entitlement programs

5. percolate [ˈpɜrkəˌleɪt] - (verb) - To filter gradually through a porous surface or substance; to spread gradually. - Synonyms: (seep, filter, trickle)

They percolate slowly and it just creeps up on you.

6. gdp ratio [ˌʤiːdiːˈpiː ˈreɪʃioʊ] - (noun phrase) - A comparative ratio of a country's total economic output to its national debt. - Synonyms: (gross domestic product ratio, economic ratio, fiscal ratio)

Our debt to gdp ratio is over 100% and climbing.

7. perilous [ˈpɛrələs] - (adjective) - Full of danger or risk. - Synonyms: (dangerous, hazardous, risky)

It's a real problem. I mean, financial crisis like this don't happen at once.

8. prospects [ˈprɒs.pɛkts] - (noun) - The possibility or likelihood of some future event occurring. - Synonyms: (chances, opportunities, potential)

What do you think is sort of the outlook next year?

9. regulatory [ˈrɛɡjʊləˌtɔri] - (adjective) - Related to the action of controlling or managing a process, system, industry, etc., especially by rules. - Synonyms: (administrative, controlling, governing)

You're going to see a, you know, which, which, I think a lot of us you're going to see a lot of this regulation over regulation we've had go away.

10. deficit [ˈdefɪsɪt] - (noun) - The amount by which something, especially a sum of money, is too small. - Synonyms: (shortfall, deficiency, gap)

My biggest worry about our economy is our deficit, our debt to Duke, national debt, our debt to gdp ratio is over 100% and climbing.

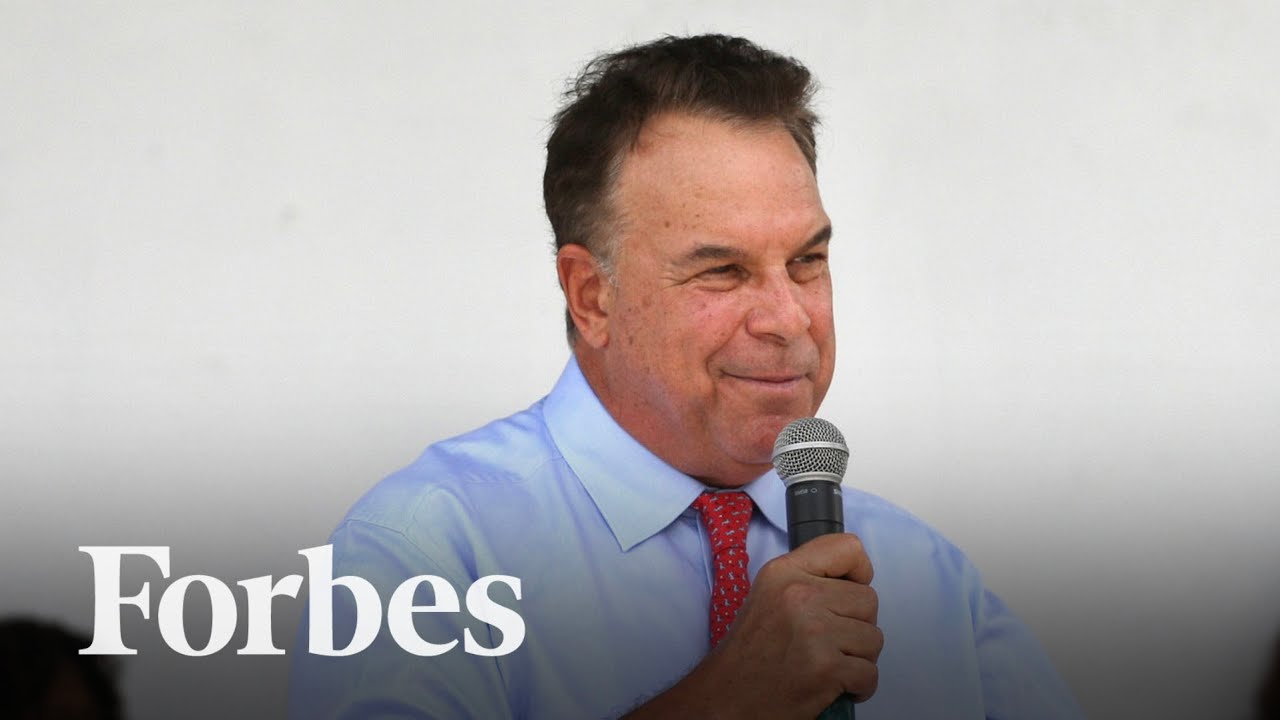

Real Estate Billionaire Jeff Greene On Trump Victory, Florida Results

Hi, my name is Giacomo Cenini and I'm a reporter at Forbes. Joining me here today is Jeff Green, real estate investor and financial investor based in Florida. Jeff, thanks so much for being here. How are you today? Great, great, great to be here. Thanks. So I wanted to check in with you to get your sort of thoughts on the election. Obviously you live in Florida, have been investing there for a long time. So first off, just wanted to get your thoughts and sort of your reaction this morning.

Well, I mean, generally, most of my Democratic leanings since growing up in Massachusetts, most of my political leaning since growing up in Massachusetts have been Democratic. The first election I remember was John F. Kennedy. I was a little kid and basically the reason is, I mean, I started with it absolutely nothing. I've lived the American dream and I realized that the government can really play a role in, in helping people to achieve what I've achieved. And you know, I've always felt that talent is, you know, is evenly dispersed among all people all over the world, regardless of their race or their age or their nationality. But what's not evenly distributed is opportunity. And so I've always felt the Democratic Party was a little more focused than the Republican Party on, you know, on really providing opportunities to people just, you know, through education and health care and housing and the kinds of things to kind of get everyone to the same starting line in life. And so that's why I've kind of supported, But I've been voted for Republicans too. And I certainly understand the, the, the ideas behind the Republican platform and the economy, which is of course, you know, get government out of the way and pro growth policies. And if you have a going, I mean, there will be more opportunities for everybody. So look, both sides have good ideas and I'm, you know, now Donald Trump's our president and I'm, you know, I'm trying to want to get excited about the opportunity for him to bring the country together and, and hopefully, you know, hopefully get into, to a great period of opportunity for more and more markets.

And I was curious to ask you, you know, you also live in Palm beach near Mar a Lago, I think used to be a member there as well. What was sort of how was it around there last night? Do, do you sort of see any people going in or what was kind of the mood there? Well, you don't really see too much because as there's, there's a lot of security since the fascination attempts. But I can tell you when I was driving home yesterday evening, there was quite a bit of traffic because, you know, right now any car that goes in there has to be searched. And then I used to just search the trucks. Now they touch the engine under the car with mirrors. So it's a very extensive search of every car. So as a result, if there's a lot of people coming there, you know, then they kind of line up because they have to wait to get searched. So I get stuck in the line. So I'm just trying to get home. So it's, it's a bit of a problem.

You know, look, the end of the day, you know, as far as traffic goes, it's very good news for us because, you know, Donald Trump's moving to Washington. So when they're going to see the traffic, when he's here for the holidays, which would be mostly during the winter months. And so we're all focused really on what it's going to do for our community and our country and where we're going more than the track. Right. And in terms of Florida. Right. Obviously those results came out quite early last night. What was your reaction to that? I mean, I think it was expected it would go for Trump, but I guess the degree, the size of the victory, maybe not as expected. And I know obviously you were involved a bit in Florida politics in the past. What was your, you know, were you expecting that kind of result? What was sort of your reaction to, to the Florida vote?

Well, you really can't be surprised because, you know, look, when I got it when I first got into politics here in Florida in 2010, that there were more Democrats registered Republicans. Now there's a million more Republicans registered than Democrats. So of course, it's pretty hard to lose as a Republican when you start with a million, a million, million million person advantage in registration. So that's kind of what happened. And, you know, none of us were really surprised. I don't think anyone really thought that Donald Trump was going to lose Florida or that Rick Scott was going to lose or any of these folks were going to lose. And we were a little surprised about the amendments, but one on abortion and the one on legal marijuana legalization, I think they were both at 57%. They needed 60%. So the fact is more people, the majority of the people would like to have, don't like that 6%, that six week abortion ban and the majority of people would like to have legal marijuana, but not 60%.

You know, in terms of the, you know, we've, we've spoken a few times with you about, you know, your thoughts on, on the economy and what might happen. I think I remember last time we spoke was maybe last year about potential for a recession. I guess now, you know, we sort of see the markets react the way they have today, positively. What are you expecting? I guess broadly in terms of economic picture going into next year and then as far as the Trump administration goes, well, my biggest worry about our economy is our deficit, our debt to Duke, national debt, our debt to gdp ratio is over 100% and climbing. We're heading towards 150% right now. The interest on our national debt costs more per year than our national defense budget, $800 billion per year costs. So it's a real problem. I mean, financial crisis like this don't happen at once. They percolate slowly and it just creeps up on you.

And at one point it could creep up on us and hurt us. So I think that I was disappointed that neither of the candidates were talking about that issue. And I understand why they wouldn't. If you're running for office, you don't really want to say we're going to increase taxes or are you going to cut programs. But the truth is I think that we have to do a little of both. And, you know, I really, you know, I was kind of. I think that we don't really need a tax cut from where we are today. I'm sure he's going to extend the cuts that he has, which he'll be able to do now, but I don't think we need any further tax cuts. I think we need to find ways to raise revenue and find ways to cut expense without hurting people that, who have legitimate needs in our economy.

And how do you think sort of his plans might affect that? I mean, obviously there's been a lot of talk about tariffs, but also a lot of talk about cutting spending. Do you think that balance will end? All right, look, I mean, Elon Musk said I'm going to cut $2 trillion up the budget. We all know that half of the six and a half trillion or whatever the budget is, is entitlement programs. It's to fats interest and Social Security and Medicare. So there really isn't enough. If you cut 2 trillion, it's almost like cutting everything else in the budget. So I think it's going to be hard to do. But look, I think what you're going to see, and this is what the markets are. That's why the markets are going up. You're going to see a, you know, which, which I think a lot of us you're going to see a lot of this regulation over regulation we've had go away, which will be easier for people like new entrepreneurs go out and build businesses and start companies. And that's why the people are reacting positively to that, because there's no question that's what Donald Trump, the Republican Senate will do, which is a good thing, you know, get government out of the way of business. I've always been in favor of that.

And I think that the risk, again, is, you know, is. Is I think that the national debt, you know, we have to really focus on that because, because one day we may just all wake up and no one will want to buy the bonds anymore. That happens, and rates start long, rates start to really go high. It would really hurt our economy in a very big way. And in terms of real estate, I know we've spoken a lot about how the market is changing. What do you think is sort of the outlook next year? Obviously, with rates expected to still come down a bit, A bit more of the sort of issues of supply being resolved a bit. What's your outlook for. Obviously depends on the class, but wanted to get your thoughts on that.

Well, the real estate market is a local bank. So basically the good news for us. And again, I'm, you know, one of the, you know, the bigger property owners here in this community and a lot of holdings here. You know, there's no question in my mind that having West Palm beach, you know, and everyone's telephone industry and all over the world is, is only going to help help our brand in our city. It's a fantastic community anyway. It's a great, great place to live, amazing quality of life. We have a lot of great things already happening in our community, but I think getting this global attention every time President Trump is in town and even during this, this transition period while he's here doing his transit, doing his, you know, lining up his cabinet and all his key people is only going to be, it's going to be great for our market.

As far as real estate in general, I mean, we're overbuilt in a lot of categories now. Apartments, you know, but office space. Again, look, if we have great economic growth, even if it means, you know, we can dodge the bullet that I think is heading our way from, from a, from the stack, from, from the national debt. But if we, if this, if this growth happens, it'll. There'll be more demand for apartments and office space. And look, growing an economy is a wonderful thing. I'm all in favor of growing economy we just might. I just want to hope that we're, you know, mindful of the risks of having this. These extraordinary, definite spending that, you know, Republicans and Democrats have both been doing, you know, for the last few administrations.

And did you sort of. Did you sort of get involved in the election at all in terms of donations or campaigning, or were you sort of sitting this one out? No, not really. I mean, look, I know President Trump. I mean, I lived very close by and I've known him a long time. I've really never met Kamala Harris or President Biden. I've never met them. I've never spoken to them. I don't really know them. I wasn't really involved in this election, you know, so, you know, look, I've been like every American, now Donald Trump's the president. Let's just hope everyone comes together and works together, and he works together with everyone.

And we had to get into the greatest time ever for our country because, you know, Americans have been pretty down lately, you know, and we shouldn't be, you know, this is the greatest country in the world. Everyone in the world wants to come here legally, illegally, anywhere they can get here, you know, and I think it's, you know, we're just a fantastic place and Americans should wake up. You know, there's so many great things in our country, too. You know, when you look at the benefits of AI life expectancy from Iotech and all the amazing things that we have in our lives, you know, we shouldn't be so disappointed. Idea. That's a country, you know, we should wake up in the morning, one should think like, I love being in America. I love our country. I love my life here. I mean, hopefully we'll get to that point. At the end of his four years, hopefully everyone will be really happy.

That's the goal. You're sort of like a hopeful sort of outlook, it seems, on. On the next few years, I guess. Well, look, I'm. I'm an optimist. You know, you can't be an entrepreneur without being an optimist. You know, you can, you can, you know. You know, look, and I mean, I played tennis this morning. You know, we had, we were. I was, I was a five one in the tiebreaker, and I lost eight, six. You know, stuff changes in life and tennis every day. You got to, you know, I'm ready for the next battle. And that's what I think as Americans. We have to. We have to do. We have to always be ready. And look, you know, I'm just hoping that you know, that we can get, get some of these world problems behind us that have kind of dragged us down, these immigration issues that are dividing us.

Thanks so much, Jeff. We really appreciate it. We'll be in touch. And yeah, thanks again for your time today. Always Next. All the best.

BUSINESS, ECONOMICS, POLITICS, JEFF GREEN, REAL ESTATE, US ECONOMY, FORBES